Energy efficiency regulations: The challenges for landlords

[edit] Introduction

As part of the UK’s commitment to an 80% reduction in carbon emissions by 2050, the energy efficiency regulations that govern the Minimum Energy Efficiency Standard (or MEES) published by the Government in 2015.

From 1 April 2018, these regulations will make it illegal for a landlord to grant or renew existing leases of commercial buildings with an F or G energy efficiency rating, subject to a few exemptions.

On 1 April 2023, these regulations will be extended so that no leased commercial building can have an F or G energy efficiency rating. The Government’s intention is to drive the improvements by progressively increasing the minimum energy efficiency standard set by the regulations. According to recent statistics, F and G rated properties make up approximately 18% of the building stock.

Landlords must plan ahead. The responsibility for compliance falls squarely on landlords. The regulations are detailed and the consequences are far reaching. And the penalties for breach of the regulations are severe. Renting out a non-compliant building carries a maximum penalty of £150,000. In this article, we take a look at the regulations in detail, and offer some advice on how landlords can approach the various issues.

Below are the questions that landlords should ask themselves when considering each commercial building in their portfolio.

[edit] Is the building excluded from MEES regulations?

The MEES regulations are based on those buildings which either require an Energy Performance Certificate (EPC) or which already have an EPC.

The first category of excluded buildings are those properties which do not require an EPC. There are a number of properties which fall into this category and among them are industrial sites, workshops and residential agricultural buildings with a low energy demand, temporary buildings and small buildings with a floor area of less than 50 sq. m.

Listed buildings will also be excluded but only if works to meet the energy efficiency requirements 'would unacceptably alter their character or appearance'. Further exclusions include any property let on a tenancy for less than six months and any property let on a tenancy for 99 years or more.

Finally the regulations only apply to 'tenancies.' So, if a licence was granted of serviced office space or of a pop-up shop, it could be argued that the regulations do not apply.

[edit] Is the building uncertified?

If the building does not fall in the excluded category the next question to ask is whether the building is uncertified. Despite the EPC regulations having been introduced in 2008 some buildings still do not have an EPC. This is perhaps due to the fact that the freehold has not been sold or the lease assigned or sub-let since 2008.

Uncertified properties produce a dilemma for landlords. On the one hand, if an EPC is sought now, any improvements can be made sooner rather than later. On the other hand, the mere act of seeking an EPC brings the property into the MEES arena with all the issues set out below.

[edit] Is the building exempt from MEES regulations?

If a building is neither excluded nor uncertified, a landlord may still be able to argue that it is exempt from the regulations. There are three main exemptions which the landlord can try and bring itself within:

- The energy efficiency improvements are not cost effective in that the cost of the works would still exceed the money saved on energy bills calculated over a seven year period; or

- The landlord cannot, despite reasonable efforts, obtain the necessary consents to install the necessary energy efficiency improvements from either tenants, lenders or superior landlords; or

- A suitably qualified expert provides written advice that the energy efficiency measures will reduce a property’s value by 5% or more, or that wall insulation, required to improve the property, will in fact damage it.

Whilst the above may appear to be useful 'get outs', there are disadvantages of using the exemption route:

- Exemptions will only be valid when recorded on a public register. It will therefore be public knowledge that a particular building has an F or G rating. It is also highly likely that local authorities will use this register to target their enforcement activity (see below).

- Exemptions only last for five years, after which point the landlord will need to register a new one. This new exemption might first require works to be carried out at that stage.

- Exemptions cannot be transferred to a new owner, which is likely to restrict the saleability of any building.

- Properties with an F or G rating may not be attractive to tenants (particularly if they wish to have the option of sub-letting) and landlords will be rightly concerned as to the effect on the property’s capital value.

[edit] Complying with MEES regulations

If the building is not excluded or uncertified and if the landlord does not want to claim an exemption, it will be classed as non-compliant or substandard.

Before undertaking any works the landlord should first consider having the building re-assessed. Much has changed in the methodology of EPCs since they were first introduced and the building may also have been improved since the last EPC was carried out.

If a new assessment does not produce the desired E rating or better, then the landlord will need to undertake works to improve the energy efficiency of the building. There will be both cost and timing issues with any such works.

In terms of timing, it may be simpler to undertake the works when the building is empty, but that means the landlord will bear the full cost. The more cost effective option, if possible, is to carry out the works when the tenant is still in occupation and then pass on the costs under any 'improvements' clause in the tenant’s lease.

If there is no such clause then the landlord is left with negotiating contributions from its tenant or trying to include the cost of the works as part of general maintenance and repairs to the building. Such an approach could lead to disputes. However, much will depend on the nature of the building, the type and quantity of works to be done, the length of the lease and the attitude of the tenant.

There is one other issue which should be mentioned in relation to non-compliant buildings. Whenever such a building occupied by a tenant is sold, or if the building is transferred to a lender in the case of a receivership, the new landlord will only have six months to improve the building or demonstrate that an exemption applies. This is likely to impact on portfolio sales and acquisitions.

[edit] Penalties and penalty notices

The MEES regulations make clear that a lease granted in breach of the regulations will not be void and tenants cannot be evicted as a result. The responsibility for compliance therefore falls squarely on landlords.

If the local authority believes that a building does not comply with the regulations, it has the power to serve a penalty notice on the landlord. The landlord can then ask the local authority to review its decision and, in the event that the decision is upheld, the landlord has the right to appeal the notice on various grounds.

However, landlords should also bear in mind that the penalties for breach of the regulations are severe. Providing false information on the public register or failing to comply with a compliance notice from a local authority will attract a fine of £5,000.

Beyond that, renting out a non-compliant building for less than three months will incur a fine of 10% of the building’s rateable value, rising to 20% of the building’s rateable value after three months of non-compliance. In this latter category the minimum penalty is specified as £10,000 and the maximum penalty is £150,000.

[edit] Unlocking practical commercial solutions for landlords

It is advisable that on the grant of any new lease, landlords should incorporate clauses designed to pass on the cost of any energy efficiency improvements to their tenants.

In addition, on any renewals of business tenancies under the Landlord and Tenant Act 1954 and where the tenancy is due for renewal before 1 April 2018, landlords should be seeking clauses in the new lease allowing both rights of re-entry and the ability to carry out energy efficiency improvements so that the cost of the works can be passed on to the tenants.

The inclusion of such clauses has the potential to lead to disputes as the tenant seeks to protect their position and restrict the landlord’s ability to recover the cost of any energy efficiency works.

[edit] Long reaching complications

In addition to the potential difficulties of attempting to recover the costs of energy efficiency works under poorly drafted leases and the issues with business tenancies under the 1954 Act, there are other unresolved issues for lenders and landlords.

For lenders, they are likely to impose conditions on agreements to provide finance on F and G rated buildings, thereby restricting the marketability of these buildings. As for landlords, they will be concerned about the possibility of a tenant on a rent review saying that it cannot sub-let because it is an F or G rated building.

The MEES regulations only deal with the technical aspects and so there is no guidance to how these issues will be resolved.

This article was written by Rex Cowell. It was originally published here in June 2015.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Building performance metrics.

- Display energy certificate.

- Do green buildings pay?

- Energy company obligation.

- Energy performance certificate.

- Green building.

- Ground rent.

- Landlord and Tenant Act.

- Leasehold.

- Minimum energy efficiency standard (MEES).

- Minimum energy efficiency standard regulations for domestic and non-domestic buildings.

- Performance gap.

- Retrofit.

Featured articles and news

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

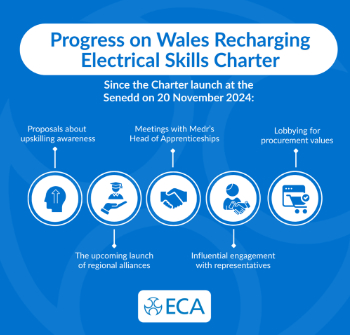

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.